Kerala PSC Previous Years Question Paper & Answer

Page:10

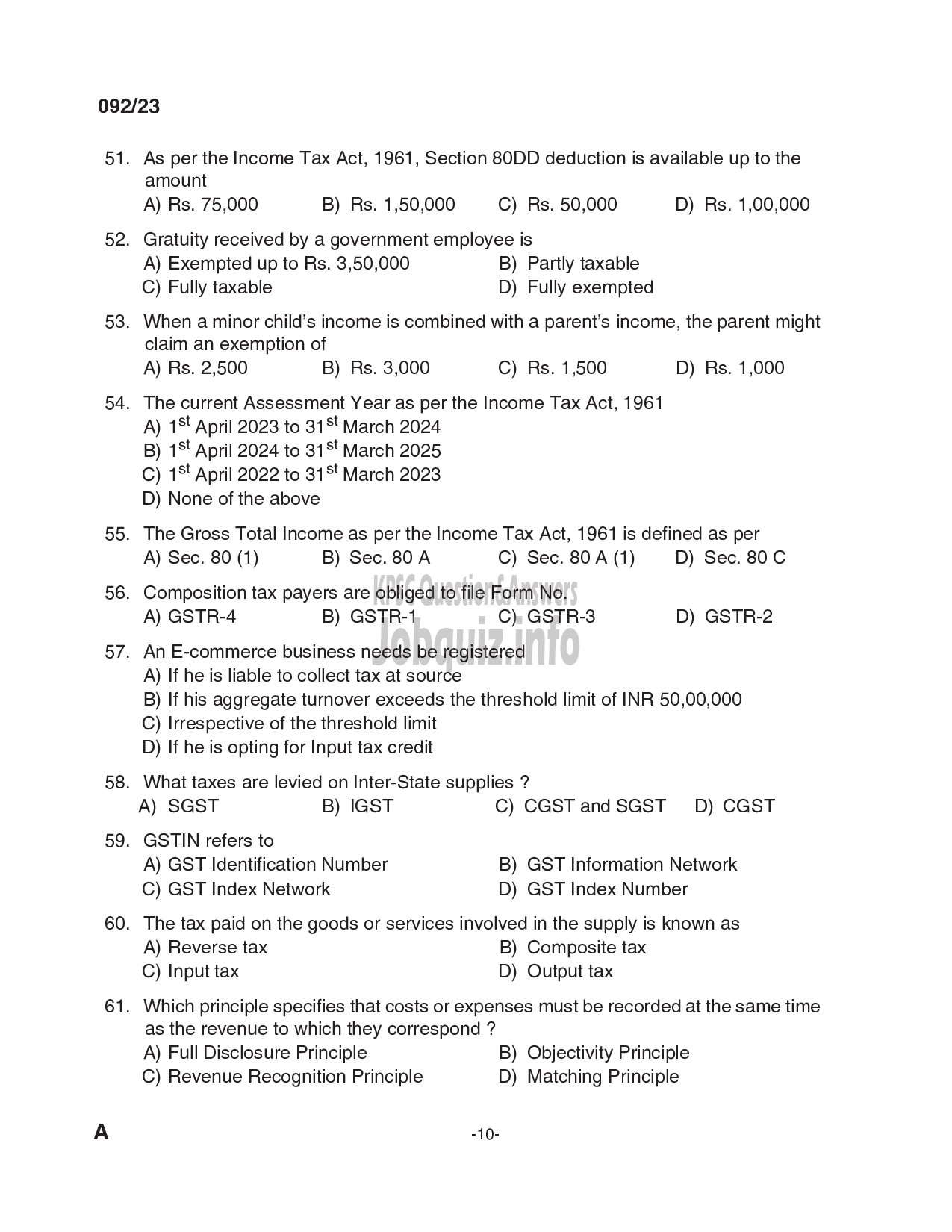

Below are the scanned copy of Kerala Public Service Commission (KPSC) Question Paper with answer keys of Exam Name ' Lecturer in Commerce' And exam conducted in the year 2023. And Question paper code was '092/2023'. Medium of question paper was in Malayalam or English . Booklet Alphacode was 'A'. Answer keys are given at the bottom, but we suggest you to try answering the questions yourself and compare the key along wih to check your performance. Because we would like you to do and practice by yourself.

092/23

51.

52.

53.

54.

55.

56.

57.

58.

59.

60.

61.

As per the Income Tax Act, 1961, Section 80DD deduction is available up to the

amount

A) Rs. 75,000 B) Rs. 1,50,000 C) Rs. 50,000 D) Rs. 1,00,000

Gratuity received by a government employee is

A) Exempted up to Rs. 3,50,000 B) Partly taxable

C) Fully taxable D) Fully exempted

When a minor child’s income is combined with a parent’s income, the parent might

claim an exemption of

A) Rs. 2,500 B) Rs. 3,000 C) Rs. 1,500 D) Rs. 1,000

The current Assessment Year as per the Income Tax Act, 1961

A) 18! April 2023 to 318! March 2024

B) 18! April 2024 to 318! March 2025

@) 19 April 2022 to 318 March 2023

D) None of the above

The Gross Total Income as per the Income Tax Act, 1961 is defined as per

A) Sec. 80 (1) B) Sec. 80A C) Sec. 80 A (1) D) Sec. 80 C

Composition tax payers are obliged to file Form No.

A) GSTR-4 B) GSTR-1 C) GSTR-3 D) GSTR-2

An E-commerce business needs be registered

A) If he is liable to collect tax at source

B) If his aggregate turnover exceeds the threshold limit of INR 50,00,000

C) Irrespective of the threshold limit

D) If he is opting for Input tax credit

What taxes are levied on Inter-State supplies ?

A) SGST B) IGST ೦) ೦5517 ೫೮ 5557 28) ೦೦57

GSTIN refers to

A) GST Identification Number B) GST Information Network

C) GST Index Network D) GST Index Number

The tax paid on the goods or services involved in the supply is known as

A) Reverse tax B) Composite tax

C) Input tax D) Output tax

Which principle specifies that costs or expenses must be recorded at the same time

as the revenue to which they correspond ?

A) Full Disclosure Principle B) Objectivity Principle

C) Revenue Recognition Principle D) Matching Principle

-10-