Kerala PSC Previous Years Question Paper & Answer

Page:7

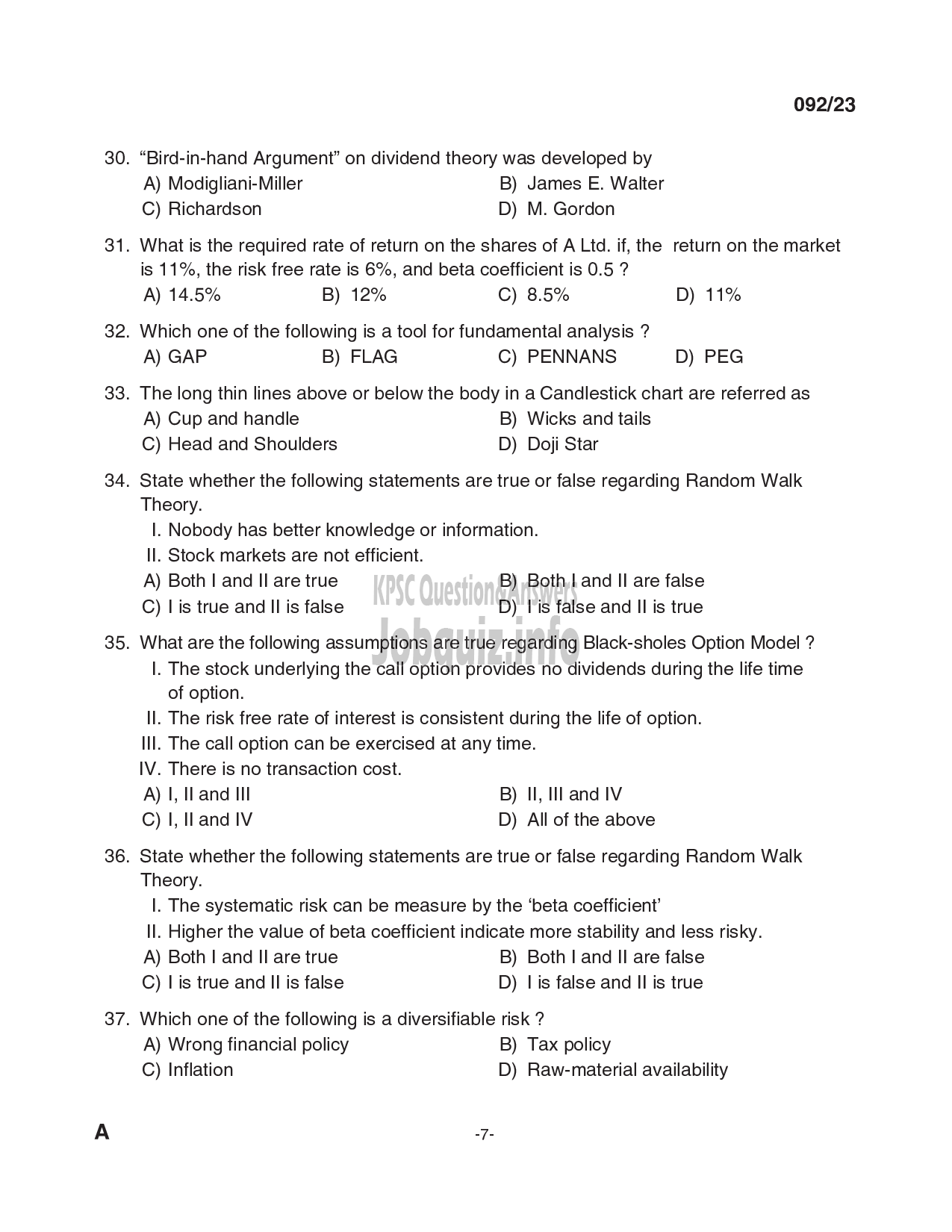

Below are the scanned copy of Kerala Public Service Commission (KPSC) Question Paper with answer keys of Exam Name ' Lecturer in Commerce' And exam conducted in the year 2023. And Question paper code was '092/2023'. Medium of question paper was in Malayalam or English . Booklet Alphacode was 'A'. Answer keys are given at the bottom, but we suggest you to try answering the questions yourself and compare the key along wih to check your performance. Because we would like you to do and practice by yourself.

30.

31.

32.

33.

34.

35.

36.

37.

092/23

“Bird-in-hand Argument” on dividend theory was developed by

A) Modigliani-Miller B) James E. Walter

C) Richardson D) M. Gordon

What is the required rate of return on the shares of A Ltd. if, the return on the market

is 11%, the risk free rate is 6%, and beta coefficient is 0.5 ?

A) 14.5% B) 12% C) 8.5% D) 11%

Which one of the following is a tool for fundamental analysis ?

A) GAP B) FLAG C) PENNANS D) PEG

The long thin lines above or below the body in a Candlestick chart are referred as

A) Cup and handle B) Wicks and tails

C) Head and Shoulders D) Doji Star

State whether the following statements are true or false regarding Random Walk

Theory.

|. Nobody has better knowledge or information.

Il. Stock markets are not efficient.

A) Both | and II are true B) Both | and Il are false

C) Lis true and Il is false D) Lis false and II is true

What are the following assumptions are true regarding Black-sholes Option Model ?

|. The stock underlying the call option provides no dividends during the life time

of option.

ll. The risk free rate of interest is consistent during the life of option.

Ill. The call option can be exercised at any time.

IV. There is no transaction cost.

A) |, land Ill B) Il, Ill and IV

C) I, land IV D) All of the above

State whether the following statements are true or false regarding Random Walk

Theory.

|, The systematic risk can be measure by the ‘beta coefficient’

Il. Higher the value of beta coefficient indicate more stability and less risky.

A) Both | and II are true B) Both | and Il are false

C) Lis true and Il is false D) Lis false and II is true

Which one of the following is a diversifiable risk ?

A) Wrong financial policy B) Tax policy

C) Inflation D) Raw-material availability

-7-