Kerala PSC Previous Years Question Paper & Answer

Page:6

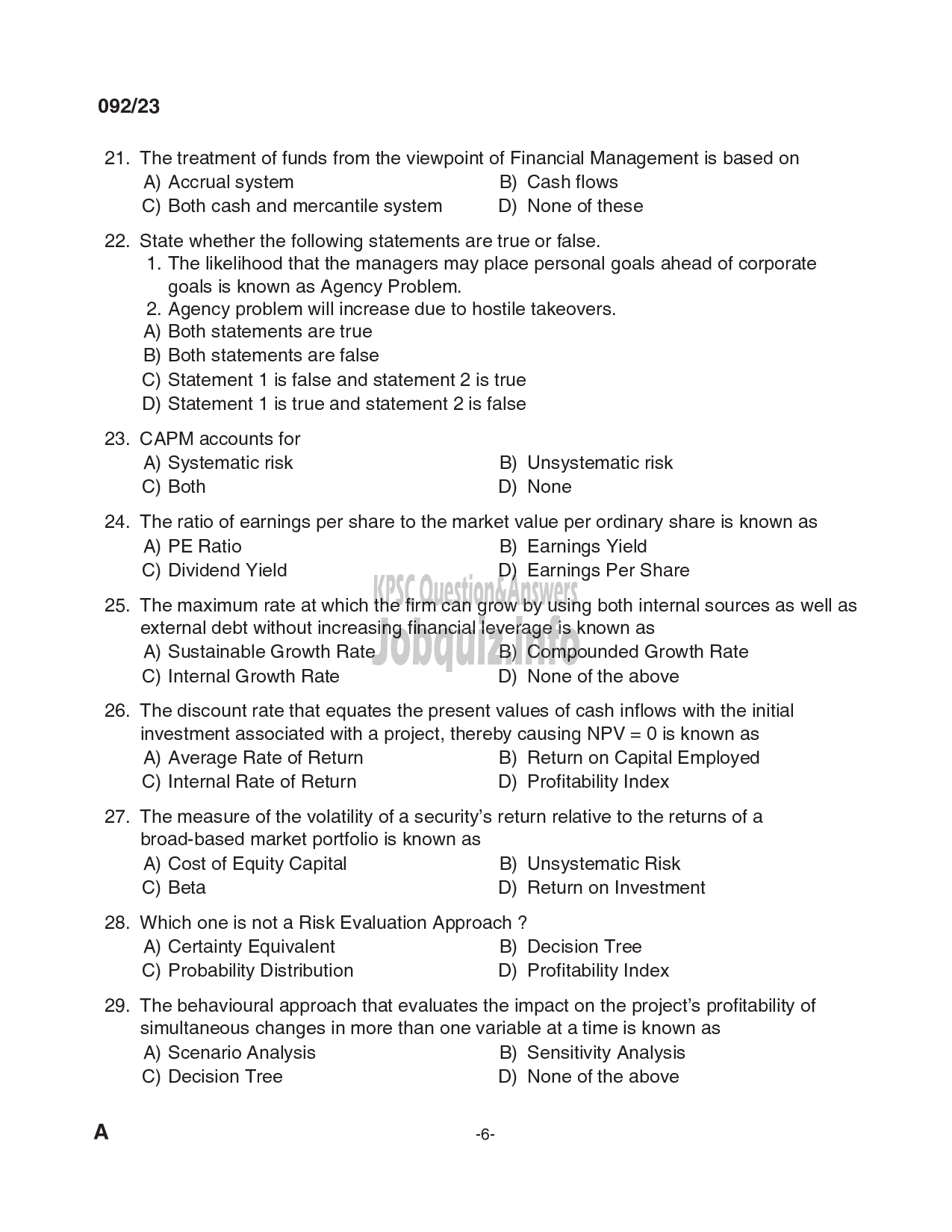

Below are the scanned copy of Kerala Public Service Commission (KPSC) Question Paper with answer keys of Exam Name ' Lecturer in Commerce' And exam conducted in the year 2023. And Question paper code was '092/2023'. Medium of question paper was in Malayalam or English . Booklet Alphacode was 'A'. Answer keys are given at the bottom, but we suggest you to try answering the questions yourself and compare the key along wih to check your performance. Because we would like you to do and practice by yourself.

092/23

21.

22.

23.

24.

25.

26.

27.

28.

29.

The treatment of funds from the viewpoint of Financial Management is based on

A) Accrual system B) Cash flows

C) Both cash and mercantile system D) None of these

State whether the following statements are true or false.

1. The likelihood that the managers may place personal goals ahead of corporate

goals is known as Agency Problem.

2. Agency problem will increase due to hostile takeovers.

A) Both statements are true

B) Both statements are false

C) Statement 1 is false and statement 2 is true

D) Statement 1 is true and statement 2 is false

CAPM accounts for

A) Systematic risk B) Unsystematic risk

C) Both D) None

The ratio of earnings per share to the market value per ordinary share is known as

A) PE Ratio B) Earnings Yield

C) Dividend Yield D) Earnings Per Share

The maximum rate at which the firm can grow by using both internal sources as well as

external debt without increasing financial leverage is known as

A) Sustainable Growth Rate B) Compounded Growth Rate

C) Internal Growth Rate D) None of the above

The discount rate that equates the present values of cash inflows with the initial

investment associated with a project, thereby causing NPV = 0 is known as

A) Average Rate of Return B) Return on Capital Employed

C) Internal Rate of Return D) Profitability Index

The measure of the volatility of a security’s return relative to the returns of a

broad-based market portfolio is known as

A) Cost of Equity Capital B) Unsystematic Risk

C) Beta D) Return on Investment

Which one is not a Risk Evaluation Approach ?

A) Certainty Equivalent B) Decision Tree

C) Probability Distribution D) Profitability Index

The behavioural approach that evaluates the impact on the project's profitability of

simultaneous changes in more than one variable at a time is known as

A) Scenario Analysis B) Sensitivity Analysis

C) Decision Tree D) None of the above