Kerala PSC Previous Years Question Paper & Answer

Page:1

Below are the scanned copy of Kerala Public Service Commission (KPSC) Question Paper with answer keys of Exam Name ' Head of Section in Commercial Practice - Technical Education' And exam conducted in the year 2022. And Question paper code was '63/2022/OL'. Medium of question paper was in Malayalam or English . Booklet Alphacode was 'A'. Answer keys are given at the bottom, but we suggest you to try answering the questions yourself and compare the key along wih to check your performance. Because we would like you to do and practice by yourself.

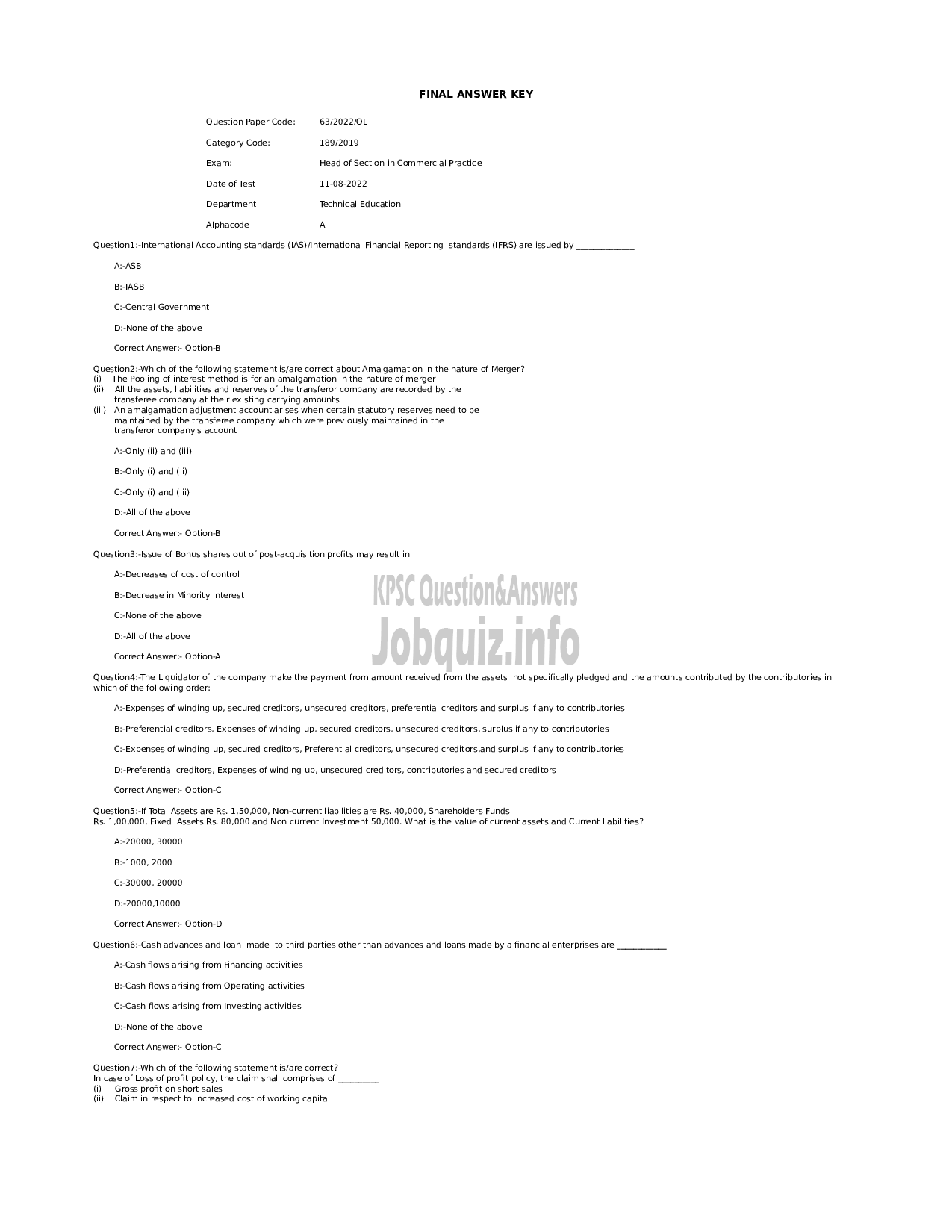

FINAL ANSWER KEY

Question Paper 6०८९; 63/2022/0L

Category Code: 189/2019

Exam: Head of Section in Commercial Practice

Date of Test 11-08-2022

Department Technical Education

Alphacode A

Question1:-Intemational Accounting standards (IAS)/International Financial Reporting standards (IFRS) are issued by

۸8

8:1858

C-Central Government

D:-None of the above

Correct Answer: 8

‘Question2::Which of the following statement is/are correct about Amalgamation in the nature of Merger?

0) The Pooling of interest method is for an amalgamation in the nature of merger

(il) All the assets, liabilities and reserves of the transferor company are recorded by the

transferee company at their existing carrying amounts

(ii) An amalgamation adjustment account arises when certain statutory reserves need to be

maintained by the transferee company which were previously maintained in the

transferor company's account

கரடி (ii) and (ii)

B-Only (i) and (1)

C-Only 0) and (ii)

०-५॥ of the above

Correct Answer: Option ®

Question3:-Issue of Bonus shares out of post-acquisition profits may result in

‘Ac Decreases of cost of control

B:-Decrease in Minority interest

C:-None of the above

०-५॥ of the above

Correct Answer:- ೦೧000

Question4:-The Liquidator of the company make the payment from amount received from the 855615 not specifically pledged and the amounts contributed by the contributories in

which of the following order:

‘Ac Expenses of winding up, secured creditors, unsecured creditors, preferential creditors and surplus if any to contributories

B:-Preferential creditors, Expenses of winding up, secured creditors, unsecured creditors, surplus if any to contributories

C:Expenses of winding up, secured creditors, Preferential creditors, unsecured creditors and surplus if any to contributories

D:-Preferential creditors, Expenses of winding Up, unsecured creditors, contributories and secured creditors

Correct Answer: Option-C

‘QuestionS:-If Total Assets are Rs. 1,50,000, Non-current liabilities are Rs. 40,000, Shareholders Funds

Rs. 2,00,000, Fixed Assets Rs. 80,000 and Non current Investment 50,000. What is the value of current assets and Current liabilities?

ಸ-20000, 30000

B:-1000, 2000

30000, 20000

-20000,10000

Correct Answer:- Option-D

Question6:-Cash advances and loan made to third parties other than advances and loans made by a financial enterprises are

‘AsCash flows arising from Financing activities

B:-Cash flows arising from Operating activities

C-Cash flows arising from Investing activities

D-None of the above

Correct Answer: Option-C

Question7::Which of the following statement isfare correct?

17 case of Loss of profit policy, the claim shall comprises of

(i). Gross profit on short sales

(ii) Claim in respect to increased cost of working capital