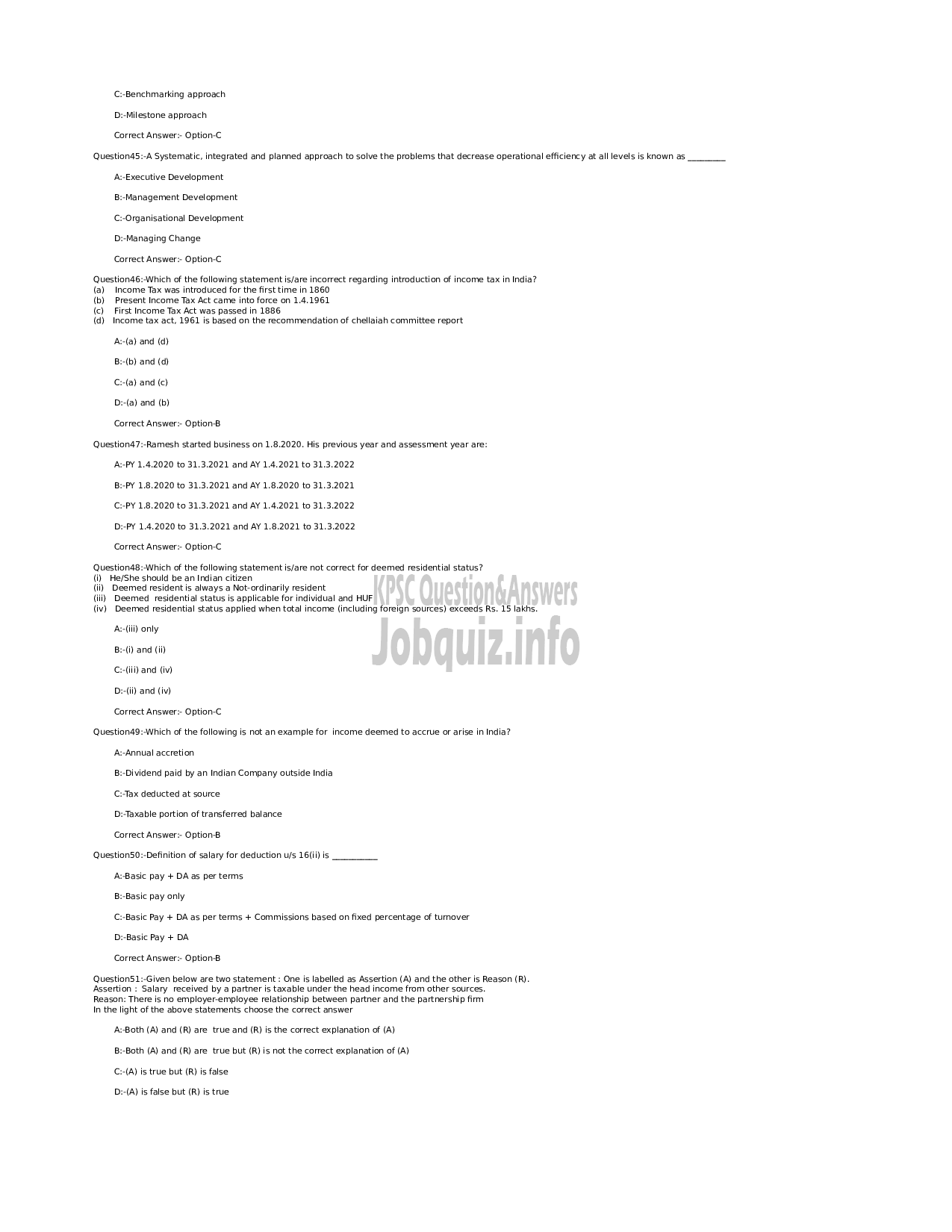

Kerala PSC Previous Years Question Paper & Answer

Page:7

Below are the scanned copy of Kerala Public Service Commission (KPSC) Question Paper with answer keys of Exam Name ' Head of Section in Commercial Practice - Technical Education' And exam conducted in the year 2022. And Question paper code was '63/2022/OL'. Medium of question paper was in Malayalam or English . Booklet Alphacode was 'A'. Answer keys are given at the bottom, but we suggest you to try answering the questions yourself and compare the key along wih to check your performance. Because we would like you to do and practice by yourself.

CBenchmarking approach

D-Milestone approach

Correct Answer: Option-C

Question45:-A Systematic, integrated and planned approach to solve the problems that decrease operational efficiency at all levels is known as,

‘Ac Executive Development

B:-Management Development

Organisational Development

D-Managing Change

Correct Answer: Option-C

Question46::Which of the following statement is/are incorrect regarding introduction of income tax in India?

(a) Income Tax was introduced for the first time in 1860

(b) Present Income Tax Act came into force on 14,1961

(9 First income Tax Act was passed in 2886

(ल) Income tax act, 1961 is based on the recommendation of chellaiah committee report

لهانم and (8)

8:-(0) and (0

८-७9) and (ದ.

D(a) and (0).

Correct Answer: Option ®

Question47:-Ramesh started business on 1.8.2020. His previous year and assessment year are:

‘APY 142020 to 31.3.2021 and AY 1.4.2021 to 313.2022

Bs-PY 1.8.2020 to 31.3.2021 and AY 1.8.2020 to 31.3.2021

೫1 12.2020 to 31.3.2021 and AY 2.4.2022 to 31.3.2022

0:೫ 1.4.2020 to 31.3.2021 and AY 2.8.2022 to 31.3.2022

Correct Answer: Option-C

Question48::Which of the following statement is/are not correct for deemed residential status?

(i), He/She should be an Indian citizen

(ii) Deemed resident is always a Not-ordinarily resident

(10 Deemed residential status is applicable for individual and HUF

(iv) Deemed residential status applied when total income (including foreign sources) exceeds Rs. 15 lakhs.

Aci) only

8:0) and (ii)

coi) and tiv)

Dei) and (iv)

Correct Answer: Option-C

Question49::Which of the following is not an example for income deemed to accrue or arise in India?

‘AcAnnual accretion

B:-Dividend paid by an Indian Company outside India

(6.०८ deducted at source

Taxable portion of transferred balance

Correct Answer: Option ®

QuestionS0:-Definition of salary for deduction 0/5 1601) 1

‘AcBasic pay + DA as per terms

B:-Basic pay only

೦-825/5 Pay + DA as per terms + Commissions based on fixed percentage of tumover

D-Basic Pay + DA

Correct Answer: Option ®

‘QuestionS1:-Given below are two statement

One is labelled as Assertion (A) and the other is Reason (8)

Assertion : Salary received by a partner is taxable under the head income fram ather sources.

Reason: There 15 no employer-employee relationship between partner and the partnership firm

In the light of the above statements choose the correct answer

8000 (A) and (R) are true and (R) is the correct explanation of (A)

Be-Both (A) and (R) are true but (R) is not the correct explanation of (A)

(2) is true but (R) is false

0:44) 15 false but (8) is true