Kerala PSC Previous Years Question Paper & Answer

Page:13

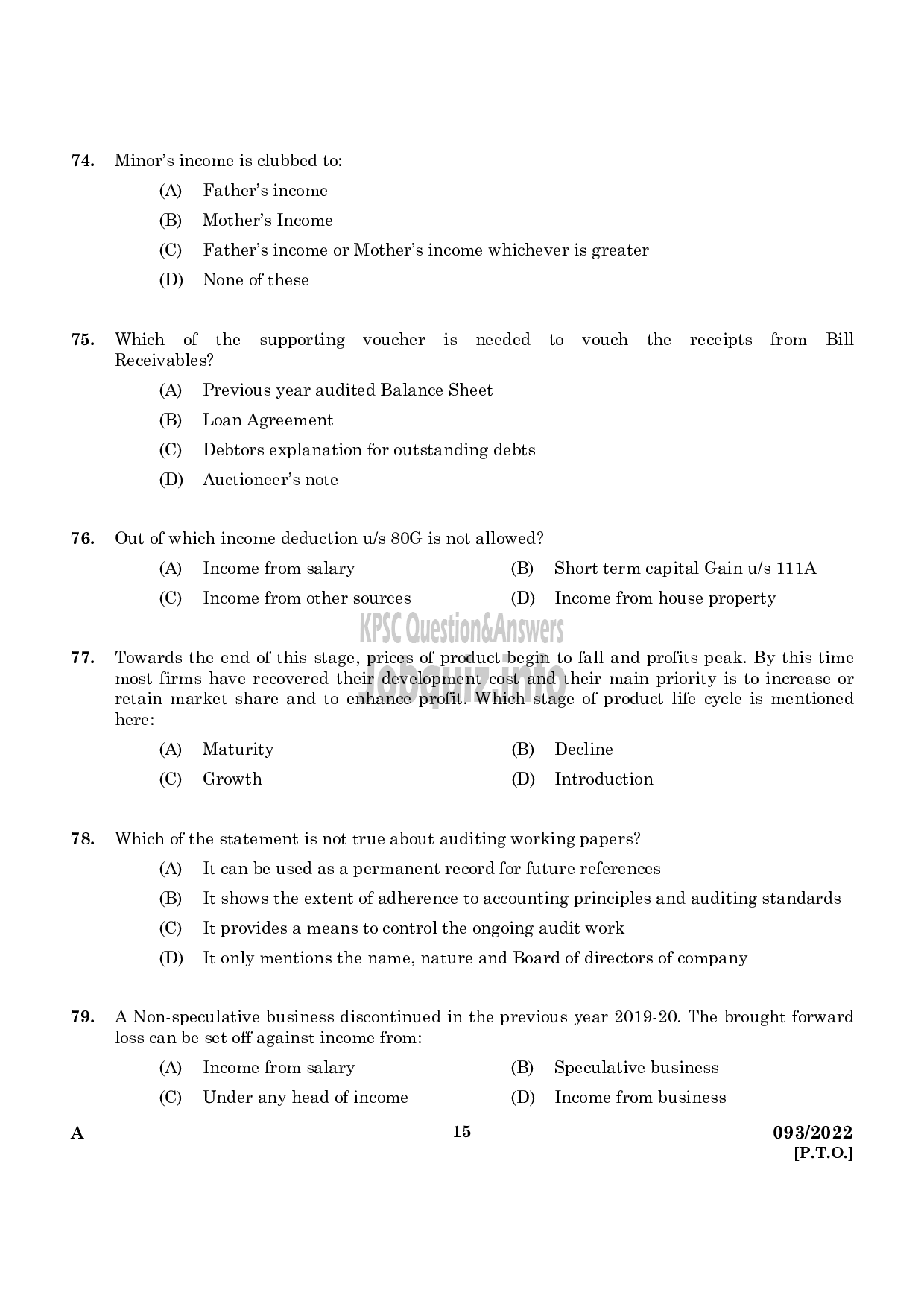

Below are the scanned copy of Kerala Public Service Commission (KPSC) Question Paper with answer keys of Exam Name 'Manager/ Store Keeper/ Accountant/ Jr Accountant/ Clerk etc in Govt owned Companies/ Corporations/ Boards etc' And exam conducted in the year 2022. And Question paper code was '093/2022'. Medium of question paper was in Malayalam or English . Booklet Alphacode was 'A'. Answer keys are given at the bottom, but we suggest you to try answering the questions yourself and compare the key along wih to check your performance. Because we would like you to do and practice by yourself.

74.

75.

76.

77.

78.

79.

11120378 income is clubbed to:

(A) Father’s income

൯) Mother’s Income

(0) Father’s income or Mother’s income whichever is greater

(D) None of these

Which of the supporting voucher is needed to vouch the receipts from Bill

Receivables?

(A) Previous year audited Balance Sheet

(B) Loan Agreement

(C) Debtors explanation for outstanding debts

(1) Auctioneer’s note

Out of which income deduction u/s 80G is not allowed?

(^) Income from salary (B) Short term capital Gain u/s 111A

(C) Income from other sources (D) Income from house property

Towards the end of this stage, prices of product begin to fall and profits peak. By this time

most firms have recovered their development cost and their main priority is to increase or

retain market share and to enhance profit. Which stage of product life cycle is mentioned

here:

(A) Maturity (B) Decline

(C) Growth () Introduction

Which of the statement is not true about auditing working papers?

(A) 1 can be used as a permanent record for future references

(B) [५ shows the extent of adherence to accounting principles and auditing standards

(C) [५ provides a means to control the ongoing audit work

(D) It only mentions the name, nature and Board of directors of company

A Non-speculative business discontinued in the previous year 2019-20. The brought forward

loss can be set off against income from:

(^) Income from salary ൯) Speculative business

(C) Under any head of income (D) Income from business

15 093/2022

[.7.0.]