Kerala PSC Previous Years Question Paper & Answer

Page:1

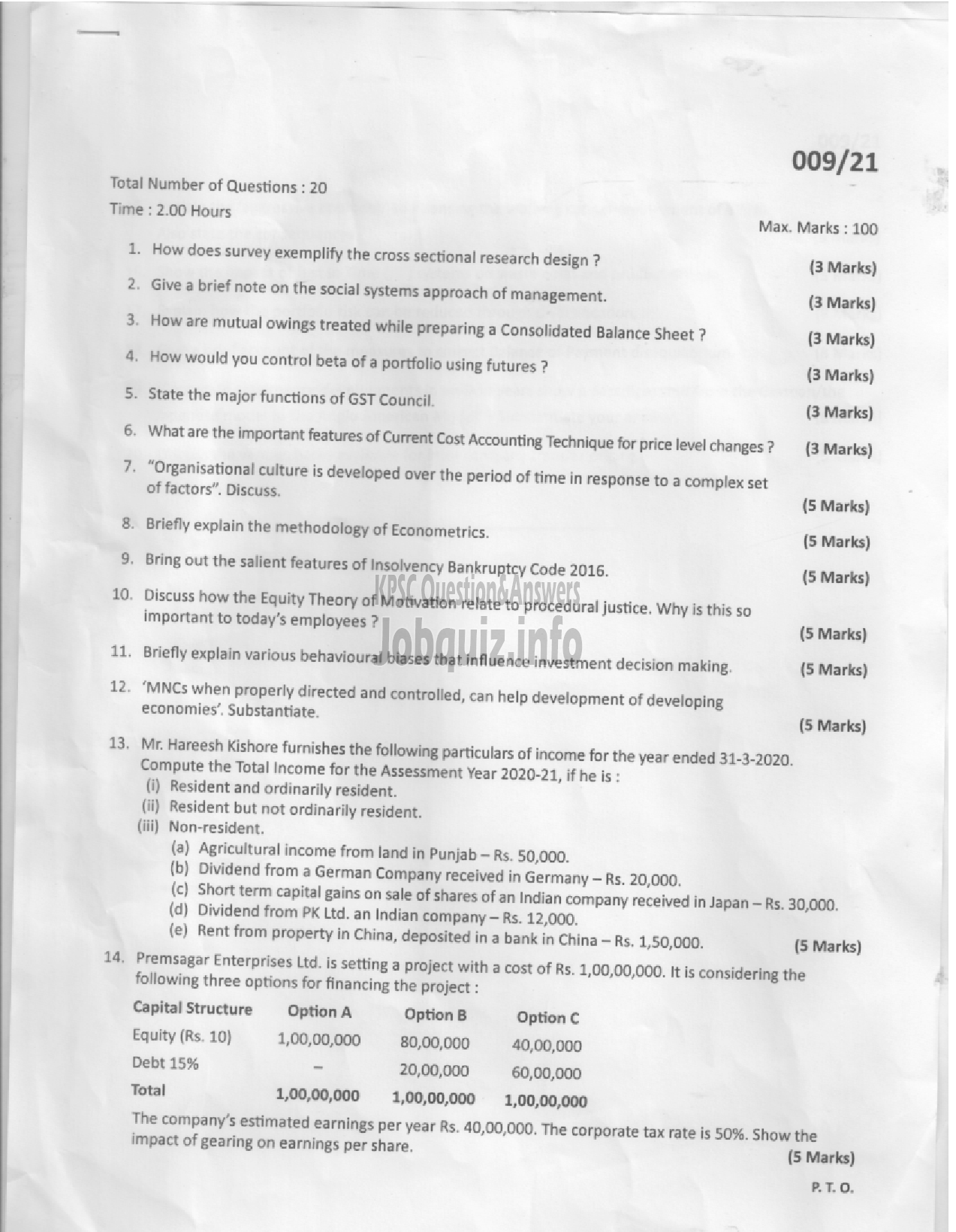

Below are the scanned copy of Kerala Public Service Commission (KPSC) Question Paper with answer keys of Exam Name 'ASSISTANT PROFESSOR - COMMERCE ' And exam conducted in the year 21. And Question paper code was '009/21'. Medium of question paper was in Malayalam or English . Booklet Alphacode was 'A'. Answer keys are given at the bottom, but we suggest you to try answering the questions yourself and compare the key along wih to check your performance. Because we would like you to do and practice by yourself.

Total Number of Questions : 20

Time : 2.00 Hours

1.

2,

3

4.

ചയ Ww

12.

13,

14.

How does survey exemplify the cross sectional research design ?

Give a brief note on the social Systems approach of management.

How are mutual owings treated while Preparing a Consolidated Balance Sheet ?

How would you control beta of a Portfolio using futures ?

~ State the major functions of GST Council,

. What are the important features of Current Cost Accounting Technique for price level changes ?

+ “Organisational culture is developed over the period of time in response to a complex set

of factors”. Discuss.

Briefly explain the methodology of Econometrics. ۔

Bring out the salient features of Insolvency Bankruptcy Code 2016, .

Discuss how the Equity Theory of Motivation relate to procedural justice. Why is this so ٭

important to today’s employees ?

. Briefly explain various behavioural biases that influence investment decision making.

“MNCs when properly directed and controlled, can help development of developing

economies’. Substantiate.

009/21

Max. Marks : 100

(3 Marks)

(3 Marks)

(3 Marks)

(3 Marks)

(3 Marks)

(3 Marks)

(5 Marks)

(5 Marks)

(5 Marks)

(5 Marks)

(5 Marks)

(5 Marks)

Mr. Hareesh Kishore furnishes the following particulars of income for the year ended 31-3-2020.

Compute the Total Income for the Assessment Year 2020-21, if he is :

(1) Resident and ordinarily resident.

(11 Resident but not ordinarily resident,

(ili) Non-resident.

(a) Agricultural income from land in Punjab - Rs. 50,000.

(b) Dividend from a German Company received in Germany - Rs. 20,000,

(०) Short term capital gains on sale of shares of an Indian company received in Japan - Rs. 30,000.

(6) Dividend from ۶۴ Ltd. an Indian company — Rs. 12,000.

(e) Rent from property in China, deposited in a bank in China - Rs. 1,50,000.

(5 Marks)

Premsagar Enterprises Ltd. is Setting a project with a cost of Rs. 1,00,00,000. It is considering the

following three options for financing the project :

Capital Structure Option A Option B Option 6

Equity (Rs. 10) 1,00,00,000 80,00,000 40,00,000

Debt 15% − 20,00,000 60,00,000

Total 1,00,00,000 1,00,00,008 1,00,00,000

The company’s estimated earnings per year Rs. 10,00,000, The Corporate tax rate is 50%. Show the

impact of gearing on earnings per share.

(5 Marks)

87.0.