Kerala PSC Previous Years Question Paper & Answer

Page:9

Below are the scanned copy of Kerala Public Service Commission (KPSC) Question Paper with answer keys of Exam Name 'Junior Manager (Accounts)' And exam conducted in the year 2022. And Question paper code was '085/2022/OL'. Medium of question paper was in Malayalam or English . Booklet Alphacode was ''. Answer keys are given at the bottom, but we suggest you to try answering the questions yourself and compare the key along wih to check your performance. Because we would like you to do and practice by yourself.

I. Acquisition of land for the purpose of carrying out Scientific Research,

11. Expenditure on advertisement in any souvenir published by a paltical party.

1४ Capital expenditure to obtain license to operate Telecommunication Services.

:۸ھ ۷

B:-Only land Il

0۷

D:-Only tl and Iv

Correct Answer: Option:

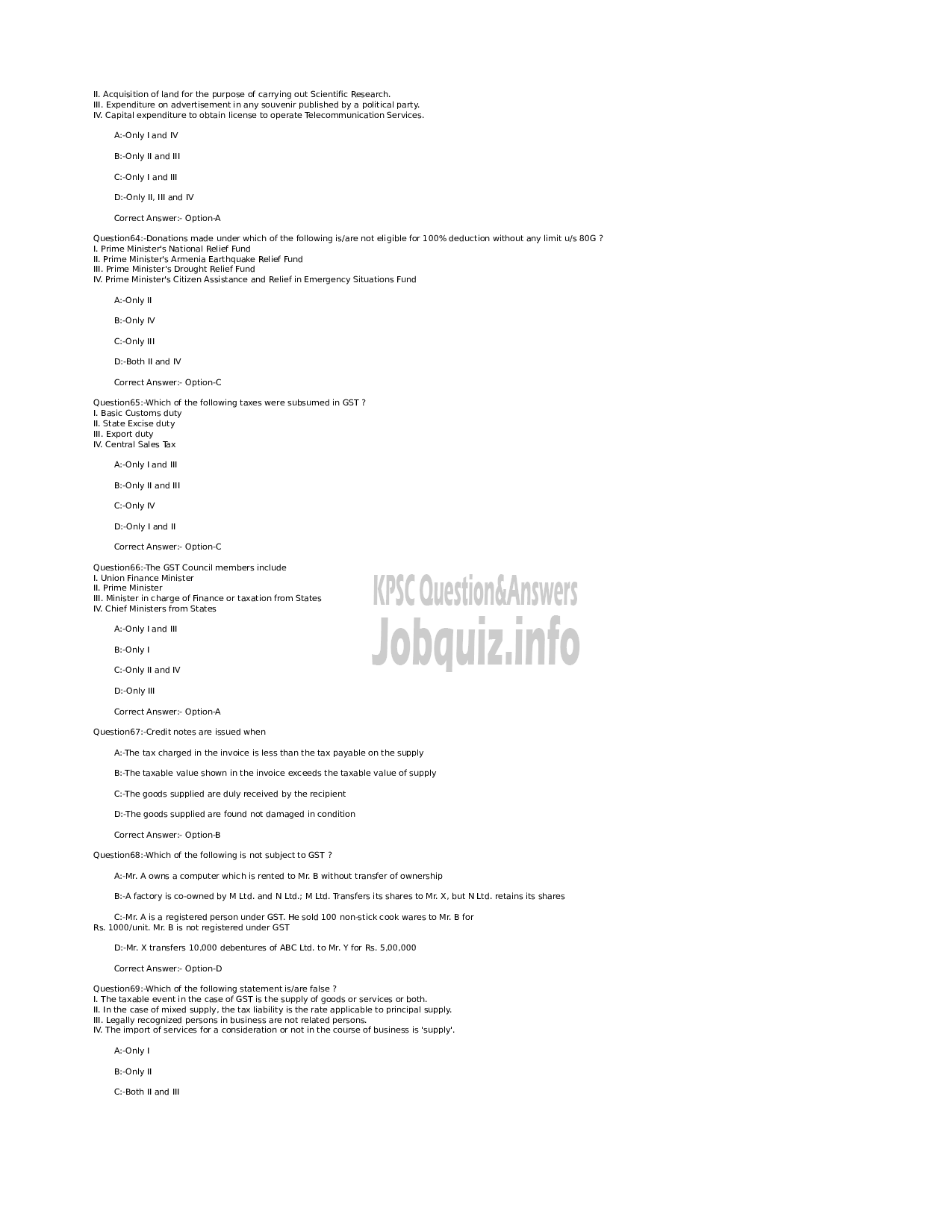

Question64:-Donations made under which of the following is/are not eligible for 100% deduction without any limit u/s 80G ?

1: Prime Minister's National Relief Fund

Il Prime Minister's Armenia Earthquake Relief Fund

IM, Prime Minister's Drought Relief Fund

IV. Prime Minister's Citizen Assistance and Relief in Emergency Situations Fund

A:Only I

B-Only V

۷۷

D:-Both Il and Iv

Correct Answer: Option-C

‘Question65:-Which of the following taxes were subsumed in GST?

I. Basic Customs duty

Il. State Excise duty

IIL Export duty

IV. Central Sales Tax

A:Only land I

B:-Only land Il

0۷۵۷

D:-Only | and I

Correct Answer: Option-C

‘Question66:-The GST Council members include

I. Union Finance Minister

I. Prime Minister

1॥. Minister in charge of Finance or taxation from States

IV. Chief Ministers from States

A:Only land I

B-Only!

സേവി ഡേ

D:-Only I

Correct Answer: Option:

‘Question67:-Credit notes are issued when

കുന്നം charged in the invoice is less than the tax payable on the supply

B:-The taxable value shown in the invoice exceeds the taxable value of supply

C:-The goods supplied are duly received by the recipient

D:-The goods supplied are found not damaged in condition

Correct Answer: Option ®

‘Question68::Which of the following is not subject to 657 7

‘AcMr. A owns a computer which is rented to Mr. B without transfer of ownership

BA factory is co-owned by M Ltd. and N Ltd.; M Ltd. Transfers its shares to Mr. X, but NLtd. retains its shares

CoMr, Aisa registered person under GST. He sold 100 nonstick cook wares to Mr. B for

Rs, 1000/unit. Mr B is not registered under GST

D:-Mr. X transfers 10,000 debentures of ABC Ltd. to Mr. ¥ for ೧5. 5,00,000.

Correct Answer: Option-D

‘Question69::Which of the following statement is/are false 7

|. The taxable event in the case of GST is the supply of goods or services or both.

Il Inthe case of mixed supply, the tax liability is the rate applicable to principal supply.

IM, Legally recognized persons in business are not related persons.

IV. The import of services for a consideration or not in the course of business is ‘supply’

A:Only |

B-Only لا

೦-500 ॥ 806 الا