Kerala PSC Previous Years Question Paper & Answer

Page:9

Below are the scanned copy of Kerala Public Service Commission (KPSC) Question Paper with answer keys of Exam Name 'Junior Manager (Accounts) - Kerala State Civil Supplies Corporation Ltd' And exam conducted in the year 2022. And Question paper code was '85/2022/OL'. Medium of question paper was in Malayalam or English . Booklet Alphacode was 'A'. Answer keys are given at the bottom, but we suggest you to try answering the questions yourself and compare the key along wih to check your performance. Because we would like you to do and practice by yourself.

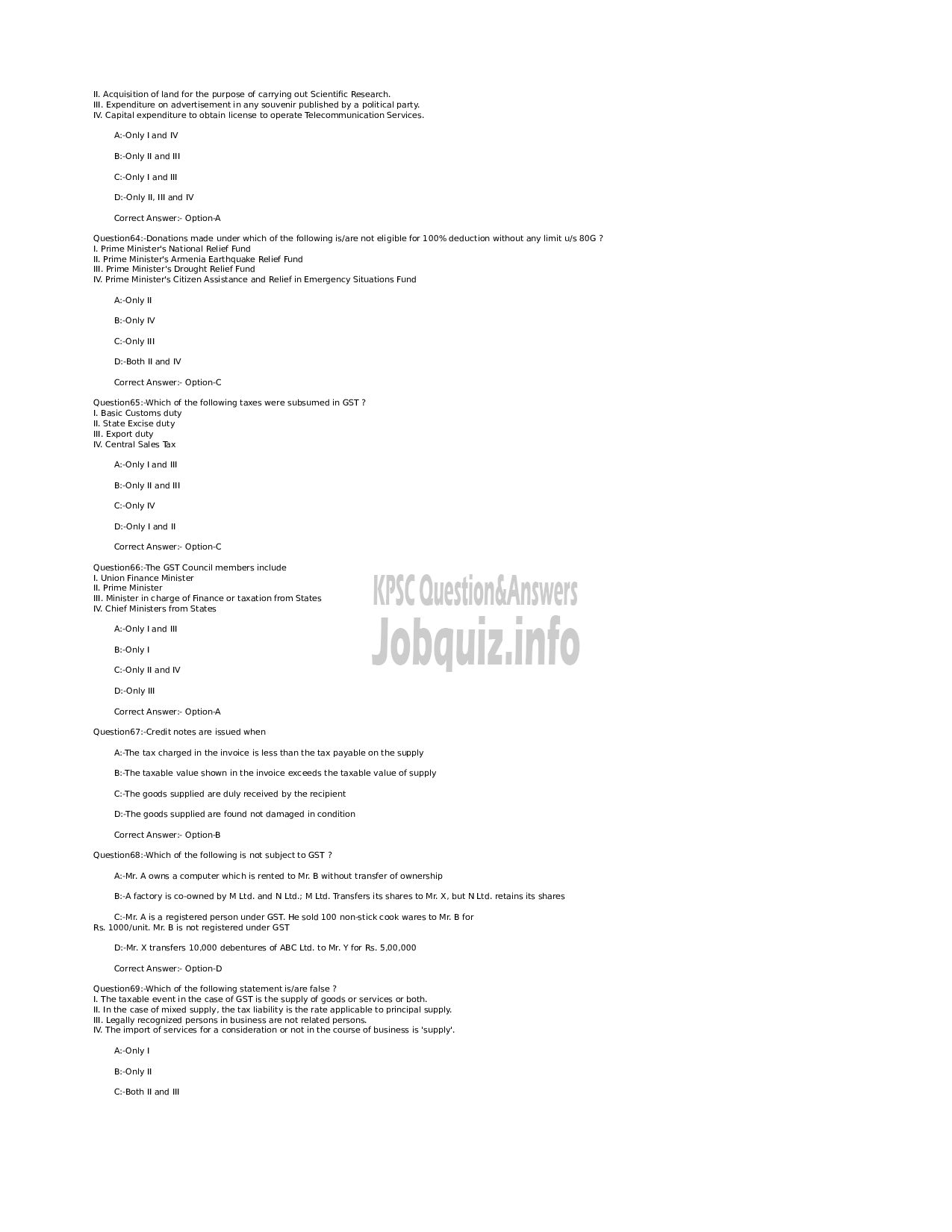

1. Acquisition of land for the purpose of carrying out Scientific Research.

11. Expenditure on advertisement in any souvenir published by a paltical party.

1४ Capital expenditure to obtain license to operate Telecommunication Services.

"۸ ۷

B:-Only ॥ 2೧ರ Il

0۷

D:-Only ,لا ॥ and ۷

Correct Answer: Option:

‘Question64:-Donations made under which of the following is/are not eligible for 100% deduction without any limit u/s 80G 7

1. Prime Minister's National Relief Fund

1. Prime Minister's Armenia Earthquake Relief Fund

IM, Prime Minister's Drought Relief Fund

IV. Prime Minister's Citizen Assistance and Relief 17 Emergency Situations Fund

५-०१४॥

B:-Only IV

۵

D:-Both ۷

Correct Answer: Option-C

‘Question65:-Which of the following taxes were subsumed in GST?

1. Basic Customs duty

॥. State Excise duty

Il Export duty

IV. Central Sales Tax

‘A:Only 126 الا

B:-Only ॥ 2೧ರ Il

11

D:-Only | and ॥

Correct Answer: Option-C

Question66:-The GST Council members include

1. Union Finance Minister

॥. Prime Minister

॥. Minister in charge of Finance or taxation fram States

IV. Chief Ministers from States

‘A:Only 126 الا

B-Only!

0ءء

D:-Only الا

Correct Answer: 0604

‘Question67:-Credit notes are issued when

കുന്നം tax charged in the invoice is less than the tax payable on the supply

ണം taxable value shown in the invoice exceeds the taxable value of supply

സട goods supplied are duly received by the recipient

D:-The goods supplied are found not damaged in condition

Correct Answer: 8

‘Question68::Which of the following is not subject to GST 7

‘AcMr. A owns a computer which is rented to Mr. B without transfer of ownership

BA factory is co-owned by M Ltd. and N Ltd.; M Ltd. Transfers its shares to Mr. X, but NLtd. retains its shares

CoMr, ۸ ئا a registered person under GST. He sold 100 nonstick cook wares to Mr. B for

Rs, 1000/unit. Mr B is not registered under GST

D:-Mr. X transfers 10,000 debentures of ABC Ltd. to Mr. ¥ for Rs. 5,00,000.

Correct Answer: Option-D

‘Question69:-Which of the following statement is/are false 7

1. The taxable event in the case of GST is the supply of goods or services or both,

Il In the case of mixed supply, the tax liability is the rate applicable to principal supply.

1॥. Legally recognized persons in business are not related persons.

IV. The import of services for a consideration or not in the course of business is ‘supply’

A:Only |

B-Only I

೦-500 ॥ and ۷